Washington D.C. – Today, March 4, 2025, the Democratic Republic of Congo offers the Trump administration minerals for military aid amid Rwanda’s rebel war. This move signals a transactional shift in U.S. policy, stirring echoes of colonial exploitation while testing modern alliances.

Rwanda Fuels Congo’s Endless War

Eastern Congo endures a decades-long conflict, inflamed by Rwanda’s alleged backing of the M23 rebel group. The strife began with the 1994 Rwandan Genocide, when Hutu extremists killed 800,000 Tutsis, spilling chaos into Congo’s refugee camps. Today, M23 controls Goma and Bukavu, bolstered—say UN reports—by 3,000 to 4,000 Rwandan troops, a claim Rwanda rejects. “The M23 did not come back on its own; it came back because Rwanda backed it,” UN commander Patrick Dube told Reuters in February 2025. Millions face displacement, a crisis tied to colonial borders Western powers drew, then left unresolved.

Congo’s Mineral Offer to Trump

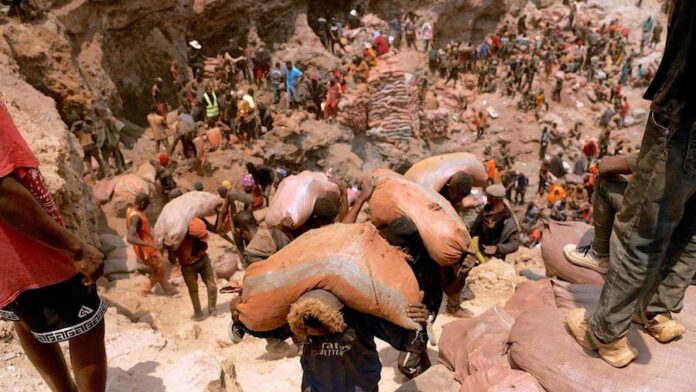

President Felix Tshisekedi pitches a deal to bypass Rwanda’s mineral smuggling. “President Tshisekedi invites the USA … to purchase them directly from us, the rightful owners,” spokesperson Tina Salama wrote on X, February 27, 2025. Congo boasts over 80% of global cobalt and vast coltan reserves—essential for tech and energy. With a weak army crumbling before M23, Tshisekedi seeks U.S. support, a bargain shaped by a history of foreign plunder, from Belgian rule to modern trade.

Trump’s Deal-Driven Foreign Policy

President Donald Trump approaches global ties like a business deal, seeking clear returns. The U.S. sanctioned Rwandan officials on February 20, 2025, hinting at interest in Congo’s offer. “I want them to give us something for all the money that we put up,” Trump said of Ukraine on February 26, 2025, a stance now guiding Congo talks. Yet, this bypasses UN peace efforts, risking tension with Rwanda, a Western ally. Critics see a repeat of old patterns—resources traded for influence—dressed as practical strategy.

Ukraine Sets Congo’s Template

Congo’s ploy mirrors a U.S.-Ukraine minerals pact nearing its endgame. Ukraine swaps lithium and rare earths for aid against Russia, easing $350 billion in U.S. costs since 2022. “We hope both US and UA leaders might sign it soon,” Ukraine’s Deputy Prime Minister Olga Stefanishyna posted on X, February 25, 2025. Congo aims to replicate this, countering China’s mine dominance and Rwanda’s theft. Since the West prioritizes Ukraine over Congo’s older crisis, selective focus rooted in past geopolitics emerges.

Minerals Power Global Rivalries

India’s mineral chase explains Congo’s leverage. Reliant on China for 80% of refined rare earths, India races to secure cobalt for electric vehicles, per Thought Smash’s January 2025 report. Superpowers and growing nations need these for tech and defense, making Congo’s reserves a global prize. China refines 60% to 90% of cobalt, tightening its grip. Western and Chinese firms compete for Congo’s wealth, often leaving chaos behind, much like colonial extractors.

What This Means for Congo and Beyond

Congo’s mineral bid aims to halt war, tapping Trump’s deal-making bent. The shift favors bilateral trades over global cooperation, threatening stability. Thousands die, nearly 1 million flee, yet peace lags. History looms: Western exploitation birthed Congo’s woes, and today’s rush for its riches risks prolonging them. For more, see Thought Smash’s M23 breakdown.